Which States Pay Out the Most for Lottery Wins

Last Updated: September 21, 2023

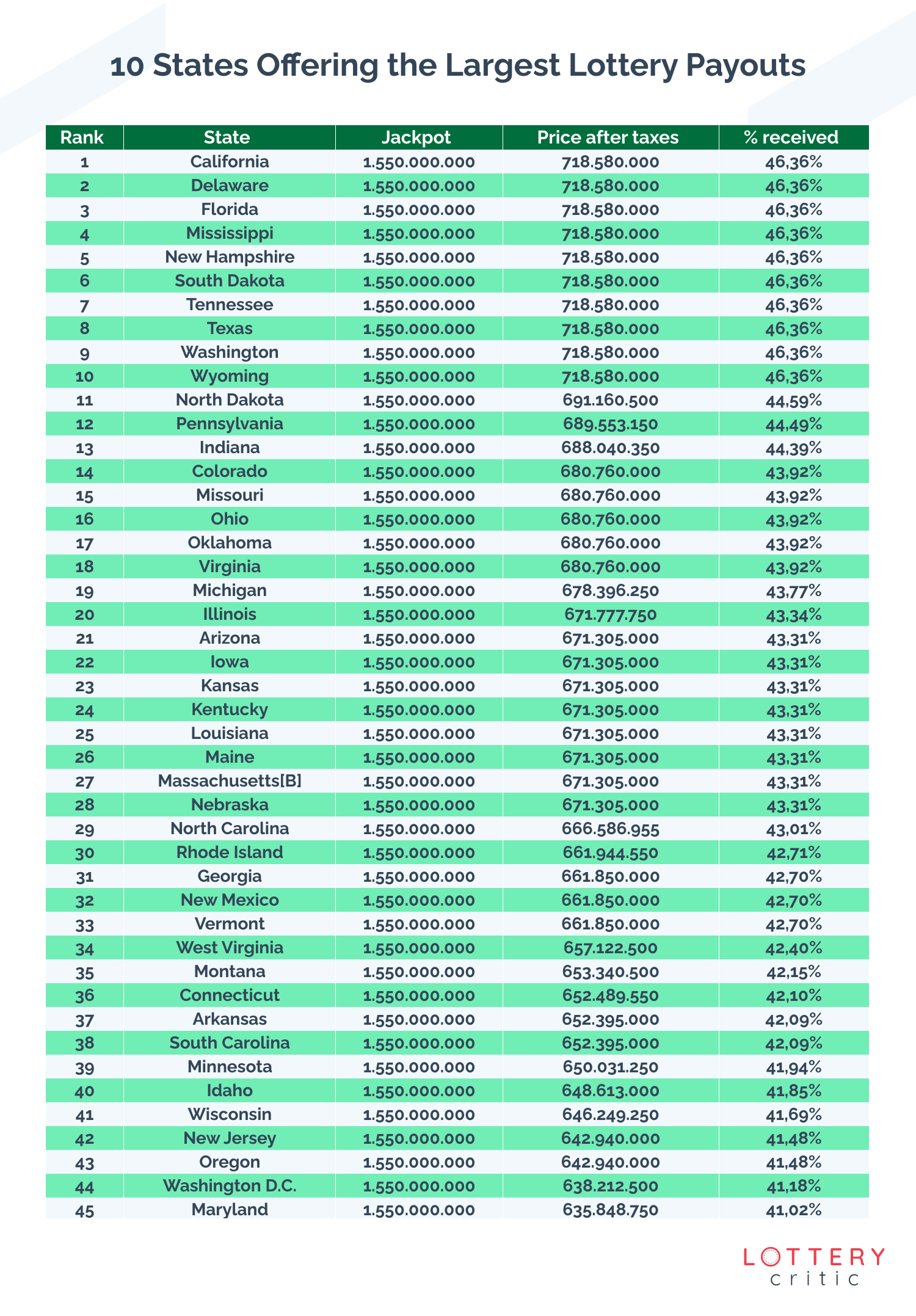

These 10 States Offer the Largest Lottery Payouts

There are 10 States in the United States which have a 0% tax rate for lottery wins: California, Delaware, Florida, Mississippi, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Assuming an average 61% cash payout from the jackpot, and a federal tax rate of 24%, winners in these ten states would take away 46.36% of the jackpot. This is great news for citizens of these states – especially for Floridians and Californians, who were found to hold the most winning tickets on the East and West Coast respectively. While New Yorkers certainly wouldn’t turn up their noses at a jackpot win, winners in this state are taxed more heavily, and would take away only 40.98% of the jackpot as payout. This means that the same $718,580,000 jackpot won by a Texan would be just $635,186,900 if won by a New Yorker. When the difference of more than $80 million could cover the cost of a luxury condo in Central Park, it might start to feel a little unfair. The difference is even more acute for winners who purchased the tickets within New York City, who can expect to be exposed to an additional city tax of 3.876% , taking a further $28 million from their winnings – there goes the once in a lifetime trip into Space with Jeff Bezos.

Winners in Maryland, Washington D.C, Oregon, New Jersey, Wisconsin, Idaho and Minnesota are all similarly blighted with lottery taxes, bringing their jackpot takings to below 42%. While Maryland is the second worst state to purchase a lottery ticket, the news is slightly better for non-residents, who are taxed at a rate of 8%, rather than the 8.95% that applies to residents, bringing their overall tax rate in line with Oregon and Washington D.C. Non-residents in Maryland are treated rather better than visitors to the Grand Canyon State of Arizona who will find that they have to pay more than residents, being taxed 6% rather than 4.8% – so it doesn’t always pay to pick up a lottery ticket from the Hoover Dam gift shop.

While New Yorkers certainly wouldn’t turn up their noses at a jackpot win, winners in this state are taxed more heavily, and would take away only 40.98% of the jackpot as payout. This means that the same $718,580,000 jackpot won by a Texan would be just $635,186,900 if won by a New Yorker. When the difference of more than $80 million could cover the cost of a luxury condo in Central Park, it might start to feel a little unfair. The difference is even more acute for winners who purchased the tickets within New York City, who can expect to be exposed to an additional city tax of 3.876% , taking a further $28 million from their winnings – there goes the once in a lifetime trip into Space with Jeff Bezos.

Winners in Maryland, Washington D.C, Oregon, New Jersey, Wisconsin, Idaho and Minnesota are all similarly blighted with lottery taxes, bringing their jackpot takings to below 42%. While Maryland is the second worst state to purchase a lottery ticket, the news is slightly better for non-residents, who are taxed at a rate of 8%, rather than the 8.95% that applies to residents, bringing their overall tax rate in line with Oregon and Washington D.C. Non-residents in Maryland are treated rather better than visitors to the Grand Canyon State of Arizona who will find that they have to pay more than residents, being taxed 6% rather than 4.8% – so it doesn’t always pay to pick up a lottery ticket from the Hoover Dam gift shop.

Mega Millions Offers the Best Jackpot

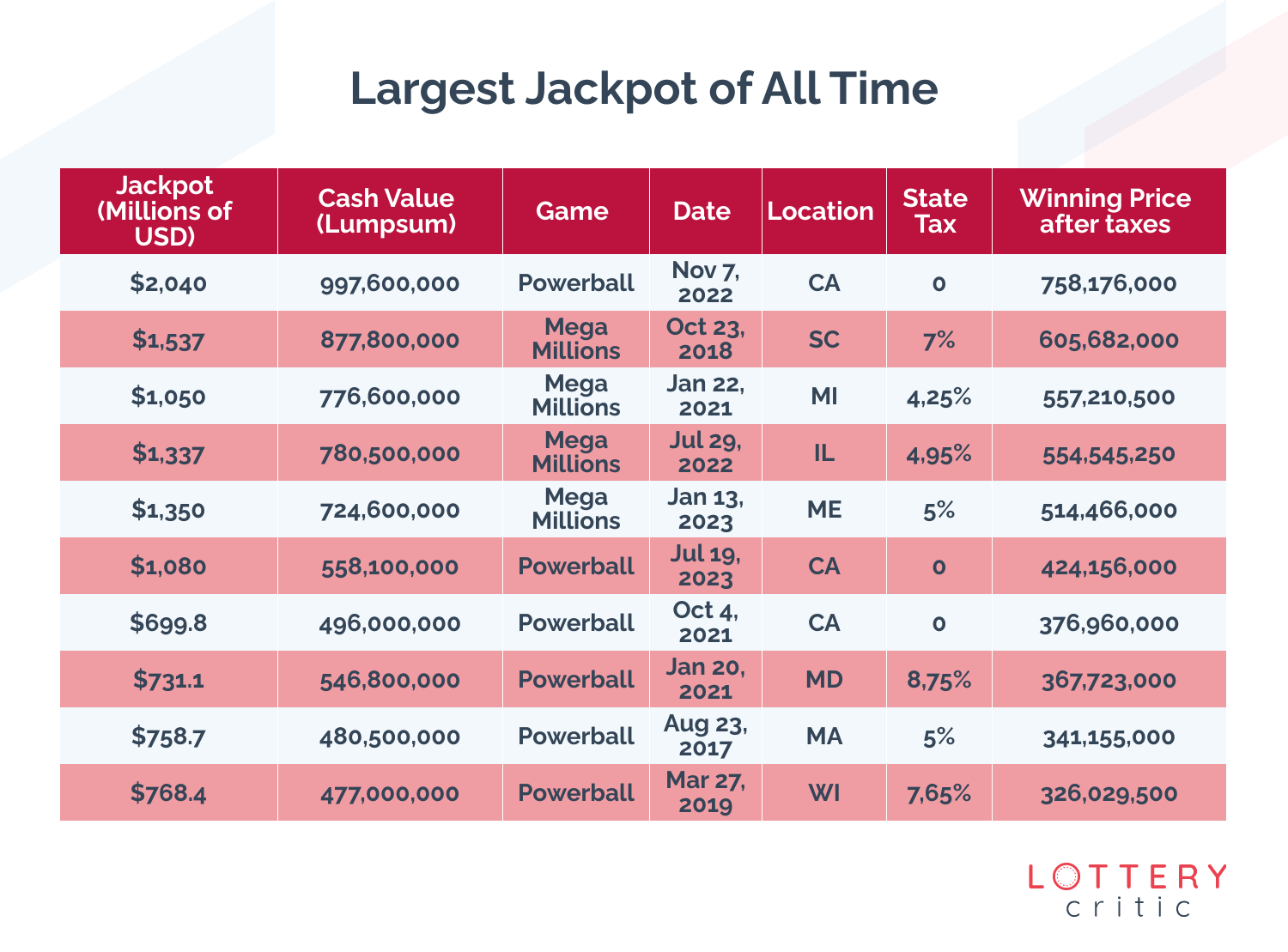

The United States has two lotteries: the Mega Millions and the Powerball. The winnings from both are subject to state and federal taxes, so from a tax perspective there is no difference between the two. Rather, the best lottery to play will depend upon that lottery’s current jackpot. At the time of writing, Mega Millions has a jackpot of $1,550,000, overtaking Powerball’s $124,000,000, so would be the obvious choice. This hasn’t always been the case though, and in fact the largest lottery jackpot of all time was a Powerball win in November 2022, when a lucky Californian resident won a colossal $2,040,000,000 jackpot, scooping up $758,176,000 after taxes and a reduction for lump sum payment. The winning ticket was bought from Joe’s Service Station in Altadena and was so large that Californian officials didn’t have the appropriate signage – taping a ‘B’ onto signs that read ‘Millionaire made here’ so that they would read ‘Billionaire’.Three of the largest Jackpots of all Time Have Been Won by Californians

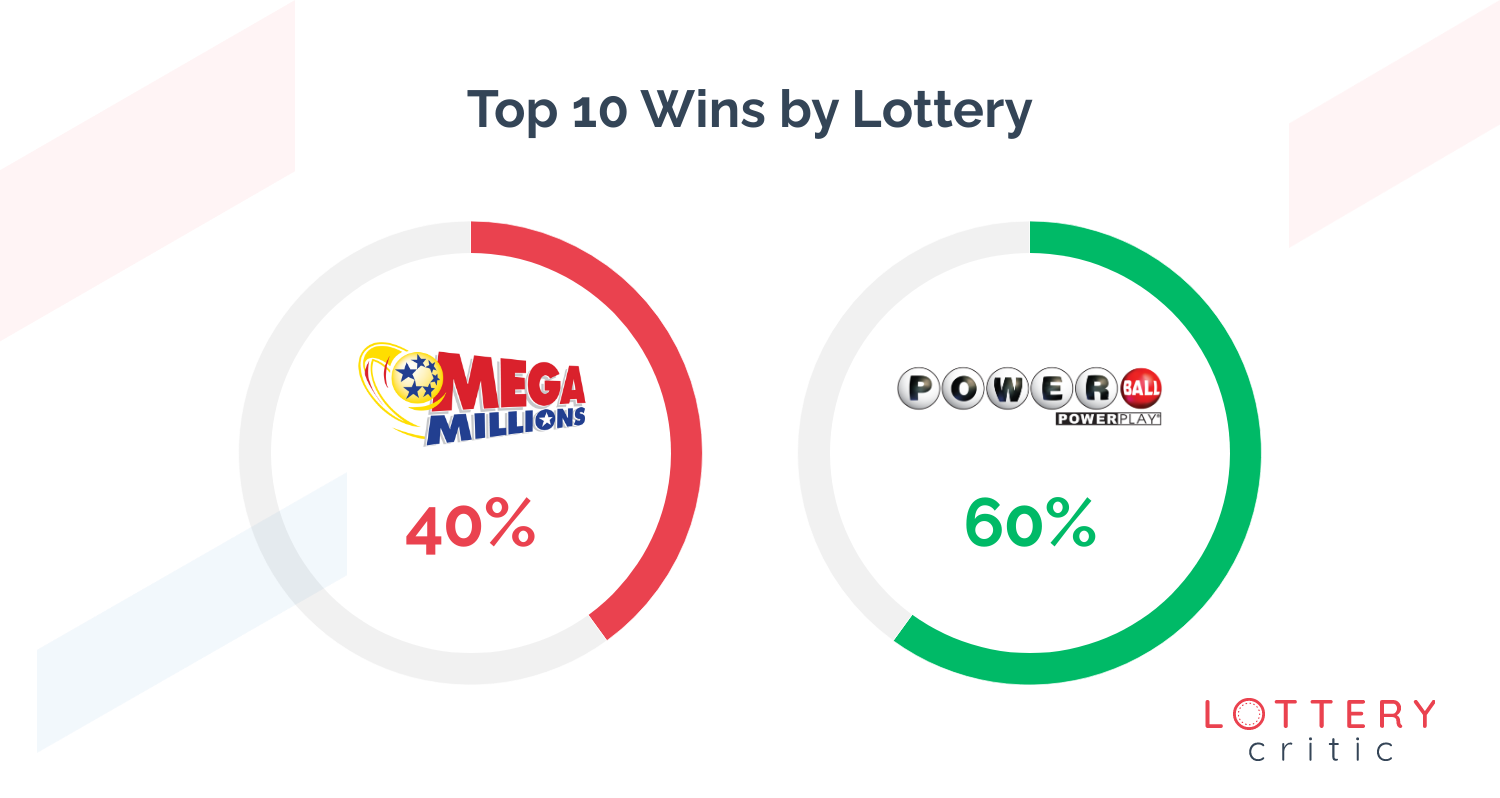

It’s probably time that California invested in some more signs, because the Golden State has seen three lottery winners in the top ten largest wins of all time, with combined winnings of $1,159 million dollars. Coincidentally, all three of California’s big wins were on the Powerball. Out of the top 10 biggest prizes, six have been given by Powerball, and four by Mega Millions. The next Mega Millions drawing has the potential to enter this top ranking, as the jackpot is $1.55 billion dollars. In recent years, the top ten biggest lottery wins go from $326 million to $758 million, with the earliest being in 2017 and the most recent in July 2023.

Out of the top 10 biggest prizes, six have been given by Powerball, and four by Mega Millions. The next Mega Millions drawing has the potential to enter this top ranking, as the jackpot is $1.55 billion dollars. In recent years, the top ten biggest lottery wins go from $326 million to $758 million, with the earliest being in 2017 and the most recent in July 2023.

The largest win on the Mega Millions was in October 2018, when a South Carolinian purchased a ticket from a town called Simpsonville netting a jackpot of £1.5 billion, or $605,682,000 reduced for lump sum payment and after the federal taxes and the 7% state tax imposed by South Carolina. If the ticket had been purchased 40 miles away in North Carolina, where the state tax is lower, the winners would have scooped up an extra $39.4 million.

The largest win on the Mega Millions was in October 2018, when a South Carolinian purchased a ticket from a town called Simpsonville netting a jackpot of £1.5 billion, or $605,682,000 reduced for lump sum payment and after the federal taxes and the 7% state tax imposed by South Carolina. If the ticket had been purchased 40 miles away in North Carolina, where the state tax is lower, the winners would have scooped up an extra $39.4 million.