From Extreme to Mainstream: The Shift in America’s Couponing Habits Amid Inflation

Last Updated: May 18, 2023

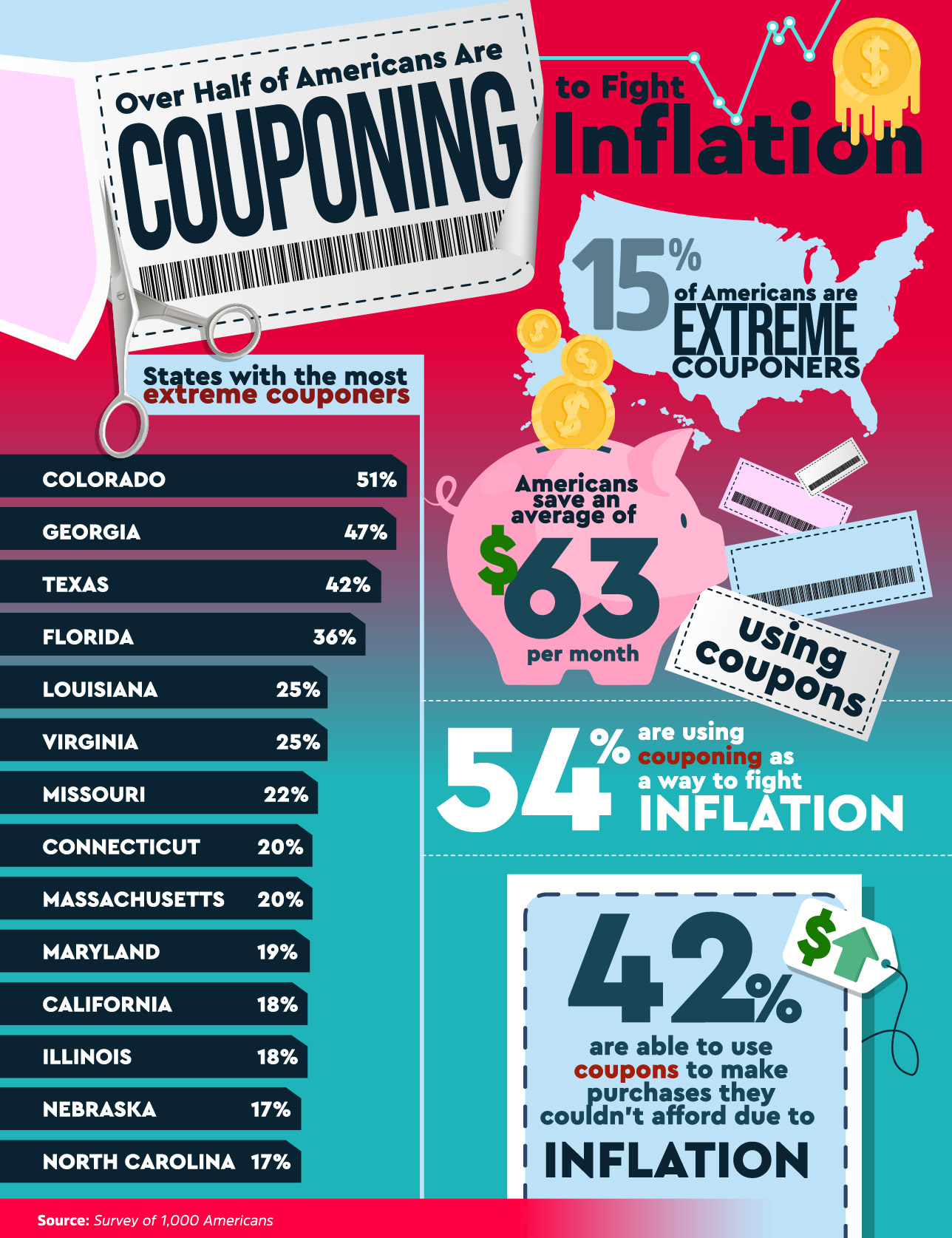

- 15% of Americans are considered extreme couponers

- More than half — 54% — of U.S. residents use coupons to fight inflation

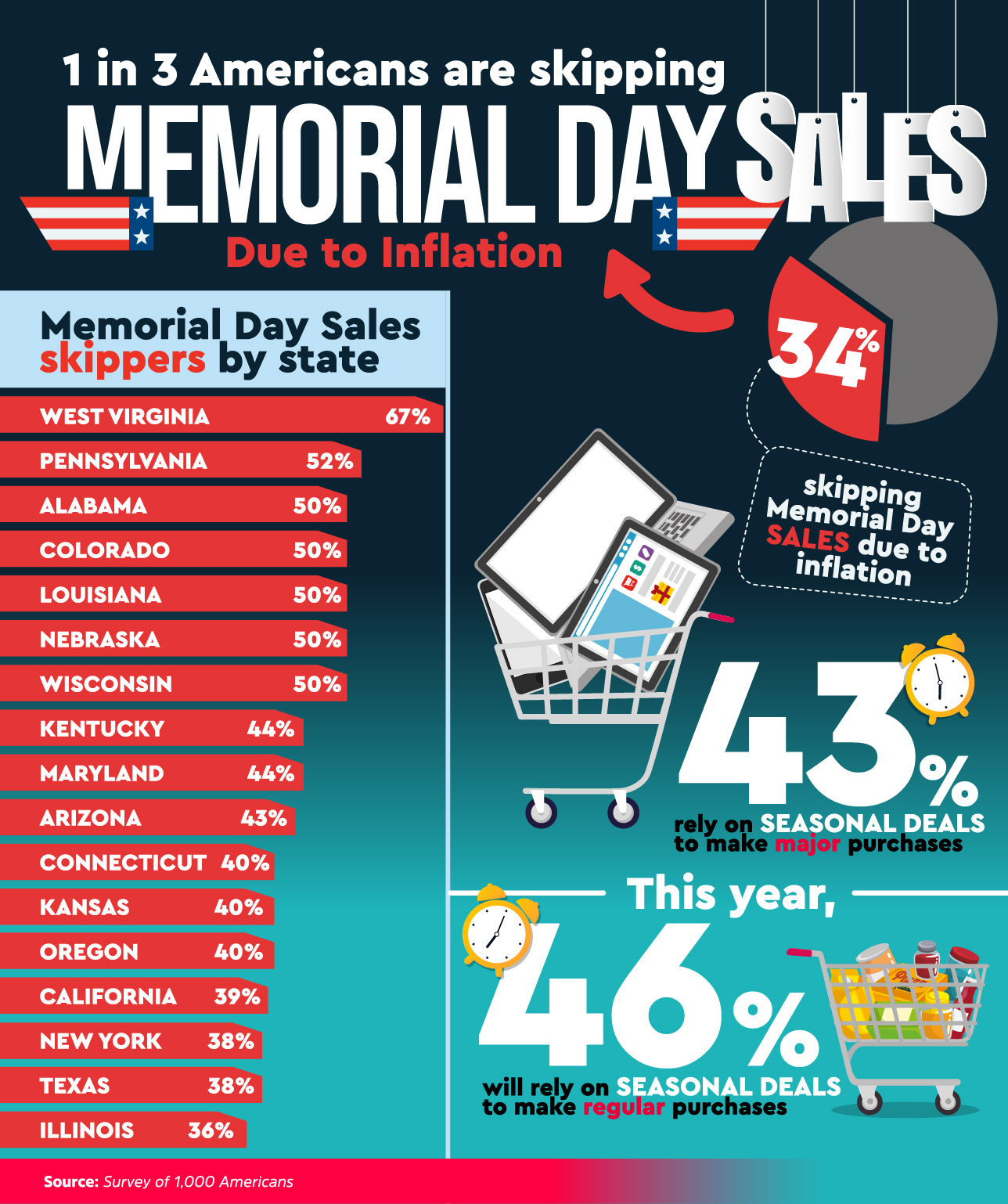

- 1 in 3 people will skip Memorial Day sales because of inflation

- 43% of Americans rely on seasonal sales to make major purchases

- Inflation will cost the retail industry around $56 billion this year

How 54% of Americans Use Coupons to Battle Inflation

We’re not sure “extreme” is the right word anymore, as 15% of Americans are considered extreme couponers. That means more than one in ten people you see at the grocery store are about to use pockets full of coupons to save big on everyday items. Residents in Colorado are the most likely to get extreme with their frugal techniques, with 51% spending time and energy to stack coupons, sniff out deals, and save. Georgia, Texas, and Florida were up there as well, coming in at 47%, 42%, and 36%, respectively.

More than half of couponers — 54%, to be exact — use couponing as a means of fighting inflation, and 42% use savings and deals to make purchases they otherwise wouldn’t be able to afford.

And even then, it seems like shoppers could be doing more to save. Americans only save an average of $63 per month using coupons. Plus, 31% don’t take advantage of the lucrative deals you can get if you actually bother to install those mobile apps for fast food and fast-casual restaurants. Not only can you skip the line at McDonald’s with their app, but you can also get deep discounts and free items just for using the app.

Residents in Colorado are the most likely to get extreme with their frugal techniques, with 51% spending time and energy to stack coupons, sniff out deals, and save. Georgia, Texas, and Florida were up there as well, coming in at 47%, 42%, and 36%, respectively.

More than half of couponers — 54%, to be exact — use couponing as a means of fighting inflation, and 42% use savings and deals to make purchases they otherwise wouldn’t be able to afford.

And even then, it seems like shoppers could be doing more to save. Americans only save an average of $63 per month using coupons. Plus, 31% don’t take advantage of the lucrative deals you can get if you actually bother to install those mobile apps for fast food and fast-casual restaurants. Not only can you skip the line at McDonald’s with their app, but you can also get deep discounts and free items just for using the app.

The Moratorium on Memorial Day Shopping

Memorial Day sales have long been a U.S. tradition. When else would thousands of people battle their way through an Old Navy to save $1 on a pair of flip-flops? But this year, 1 in 3 people will skip Memorial Day sales because of inflation. Even with deals and discounts, shopping just isn’t in the cards for 34% of America. Memorial Day shopping is getting hit the hardest in West Virginia, with 67% of residents stating they’re sitting on the sidelines because of inflation. Pennsylvania, Alabama, Colorado, Louisiana, Nebraska, and Wisconsin all come in at or above 50%.

The top ten states where residents do the most Google searches for Memorial Day deals are:

Memorial Day shopping is getting hit the hardest in West Virginia, with 67% of residents stating they’re sitting on the sidelines because of inflation. Pennsylvania, Alabama, Colorado, Louisiana, Nebraska, and Wisconsin all come in at or above 50%.

The top ten states where residents do the most Google searches for Memorial Day deals are:

- Utah

- Arizona

- Nevada

- Colorado

- Washington

- Florida

- Kansas

- Hawaii

- Arkansas

- Louisiana

The Types of Coupons Most Popular in Each State

The most popular type of coupon in the country, which tops the charts in 16 states, is one with a percentage-off deal. Free shipping coupon codes are the next most-searched-for type, with 14 states searching for it more than any other variety. These two coupon options were followed by seasonal discounts in four states and “free gift with purchase” and cashback coupons in three states each. Those meal deals we mentioned before? They’re the most popular in just two states.

These two coupon options were followed by seasonal discounts in four states and “free gift with purchase” and cashback coupons in three states each. Those meal deals we mentioned before? They’re the most popular in just two states.